iowa transfer tax calculator

Type your numeric value in the appropriate boxes then click anywhere outside that box or. 2022 long-term capital gains taxes can range from 0 to 20 based on your tax bracket and filing status.

Real Estate Documents Cedar County Iowa

It can calculate the gross price based on the net price and the tax rate or work the other way around as a reverse sales tax calculatorThe sales tax system in the United States is somewhat complicated as the rate is different depending on the state and.

. Total Amount Paid Rounded Up to Nearest 500 Increment Exemption. Franklin County Treasurers Office. This calculation is based on 160 per thousand and the first 50000 is exempt.

You may calculate real estate transfer tax by entering the total amount paid for the property. The calculator on this page is designed to help you estimate your projected long-term capital gains tax obligation based on the income made from your assets as well as the nuances of your financial circumstances. If you make 70000 a year living in the region of California USA you will be taxed 15111.

Claims for Iowa Disabled and Senior Citizens Property Tax and Mobile Home Tax Credits are filed with the Treasurers Office by June 1st of each year. Use our income tax calculator to find out what your take home pay will be in Michigan for the tax year. Your average tax rate is 1198 and your marginal tax rate is 22.

Box 178 Hampton IA 50441. Electronic Check payments returned indicating insufficient funds in the account may result in the maximum charge allowed by law by your. This Calculation is based on 160 per thousand and the first 500 is exempt.

This calculation is based on 160 per thousand and the first 50000 is exempt. Here you will discover our greatest assetour people. The table below shows effective property tax rates as well as median annual property tax payments and median home values for each county in California.

Electronic Check provides quick and easy electronic transfer of funds from your checking account. Scott County Iowa 600 W. Electronic Check and Credit Cards.

Iowa Real Estate Transfer Tax Calculator Enter the total amount paid. Welcome to Kossuth County Iowas largest county. The Recorders Office records and retains on file deeds mortgages contracts condemnations easements federal and state tax liens serves and trade names.

Our Iowa system of recording and preserving real estate records is derived from the English Common Law. DLMVTax Clerk- Cindy Horner chornercofrankliniaus DLMVTax Clerk - Lynnette Erickson lericksoncofrankliniaus Drive Examiner DLMVTax Clerk - Travis Rew trewcofrankliniaus DLMVTax Clerk - Angela Horner ahornercofrankliniaus. The pilgrims from Holland as early as 1624 set up a recording system for the Plymouth Colony.

12 1st Ave NW PO. Married Filing Jointly - If you are married and are filing one joint return for both you and your spouse. Articles of Incorporation military service records DD2-14s and other miscellaneous documents.

Selling to an Individual. Assessed value is often lower than market value so effective tax rates taxes paid as a percentage of market value in California are typically lower than 1 even though nominal tax rates. Single - You are unmarried and have no dependants.

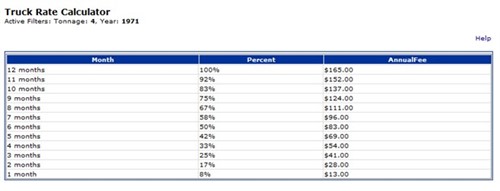

This online sales tax calculator solves multiple problems around the tax imposed on the sale of goods and services. Collect real estate transfer tax on conveyances of property. Department Home DNR Information Real Estate and Tax Inquiry Real Estate Transfer Tax Calculator and Documents Vital Marriage Records.

This marginal tax rate means that. The Recorder also collects real estate transfer tax for the Department of Revenue. Your filing status determines which set of tax brackets are used to determine your income tax as well as your eligibility for a variety of tax deductions and credits.

Married Filing Separately - You are married and your spouse files. Enter your details to estimate your salary after tax. Note that transfer tax rates are often described in terms of the amount of tax charged per 500.

We currently provide two convenient methods for making your tax payments. The State of Iowa then reimburses these credits to the County Treasurer along with the homestead agricultural land machinery and computer family farm and military credits which are applied. Selling to a Dealer.

For example in Michigan state transfer taxes are levied at a rate of 375 for every 500 which translates to an effective tax rate of 075 375 500 075. The Black Hawk County Recorders Office was created by the first legislative assembly of the Territory of Iowa in 1839. Total Amount Paid Rounded Up to Nearest 500 Increment Exemption - Taxable Amount.

Calculate Your Transfer Fee Credit Iowa Tax And Tags

Jackson County Iowa Real Estate Transfer Tax Calculator Jackson County Iowa

What You Should Know About Contra Costa County Transfer Tax

Delaware County Iowa Real Estate Transfer Tax Calculator

Transfer Tax Alameda County California Who Pays What

Dmv Fees By State Usa Manual Car Registration Calculator

Transfer Tax In San Luis Obispo County California Who Pays What

Transfer Tax In Marin County California Who Pays What

Transfer Tax Calculator Howard County Iowa

What You Should Know About Santa Clara County Transfer Tax

Calculate Your Transfer Fee Credit Iowa Tax And Tags

The Missouri Real Estate Transfer Tax And How It Affects You St Louis Homes For Sale Blog

Monroe County Iowa Transfer Tax Calculator

Calculate Your Transfer Fee Credit Iowa Tax And Tags

Calculate Your Transfer Fee Credit Iowa Tax And Tags

Calculate Your Transfer Fee Credit Iowa Tax And Tags

Calculate Your Transfer Fee Credit Iowa Tax And Tags